neighbors

Girls in Malawi, Africa walk miles every day for clean water. To raise funds for 29 remote villages of Malawi, Villages in Partnership will have a Water Walk at Valley Presbyterian Church’s …

real estate

In the heart of the Town of Paradise Valley, where privacy, picturesque mountain views and tranquility from the desert prevail, an estate nestled on 3.5 acres has been acquired by discerning buyers …

gala

Gateway Celebrity Fight Night 30th Anniversary Emerald Ball is set for Saturday, April 27 at Fairmont Scottsdale Princess. The star-studded evening of giving will deliver a knock-out blow to cancer, …

service

The Paradise Valley Police Department and Mike Cummiskey, owner of Paradise Valley Wealth Management, Inc., are teaming up again for their 10th year of on-site shredding services for town residents 8 …

Oakley’s Oath

Julie Kessler continues to advocate for the importance of taking extra precautions to protect the safety of children and pets during construction and home repair.

Kessler’s dog, Oakley, …

event

A forum organized by the Paradise Valley Independent for town council and mayoral candidates running in the July 30 election is set for 4–6 p.m. June 17 at Town Hall.

In a Q&A format, …

real estate

The 27-acre undeveloped parcel of land near Mummy Mountain in the Town of Paradise Valley was sold last week for a record-breaking $42 million — and it could have sold higher.

For nearly …

tourism

The World Travel & Tourism Council revealed at the end of March that United States travel and tourism has exceeded previous records; however, occupancy levels at Scottsdale’s hotels and …

Junior Achievement

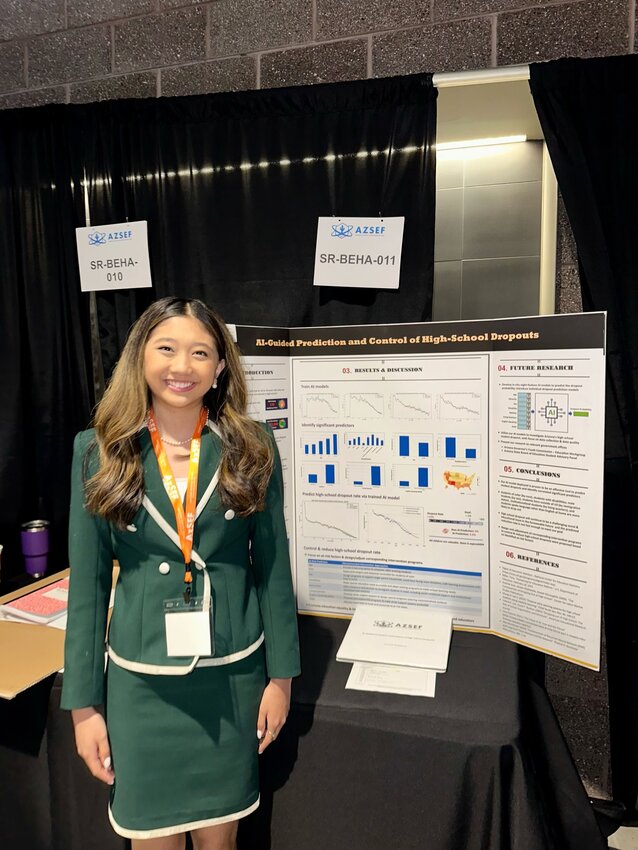

Xavier College Preparatory junior Aanvi Goel is fighting food insecurity and inequality through education.

The Paradise Valley resident started My Tasty Table as a sophomore and has since helped …

Paradise Valley Police Department is hosting the Law Enforcement Torch Run for Special Olympics Arizona in Paradise Valley this year, April 20.

The LETR will include athletes from the Special …

Read more