Paradise Valley Police Department is hosting the Law Enforcement Torch Run for Special Olympics Arizona in Paradise Valley this year, April 20.

The LETR will include athletes from the Special …

neighbors

Paradise Valley Public Works Department made an appearance at the Christ Church School's Vehicle Day on Wednesday, April 17.

The event showcased various vehicles from Public Works and other …

neighbors

This week, Paradise Valley Police Department recognized its dispatchers during National Public Safety Telecommunicators Week, April 14-20.

Dispatchers are the unseen heroes behind emergency …

neighbors

This week, PV Arts Board toured the Rotraut Gallery in Paradise Valley on Mockingbird Lane.

The gallery is for private viewings and not open to the public.

Rotraut Klein-Moquay is an …

Junior Achievement

David Guo is making a difference at an early age through art.

The Fountain Hills resident and junior at BASIS Scottsdale was one of the 18 student recipients of the Junior Achievement (JA) 18 …

Sustainability

Just over a year since its online debut, the premium running brand ALWRLD recently joined forces with REI Paradise Valley as the first retailer to launch its dynamic apparel.

Known for its …

election

Timothy Dickman has withdrawn as a candidate for Paradise Valley Town Council as of April 17 after being informed that Council Member Ellen Andeen was suing him in Maricopa County Superior Court with …

submission

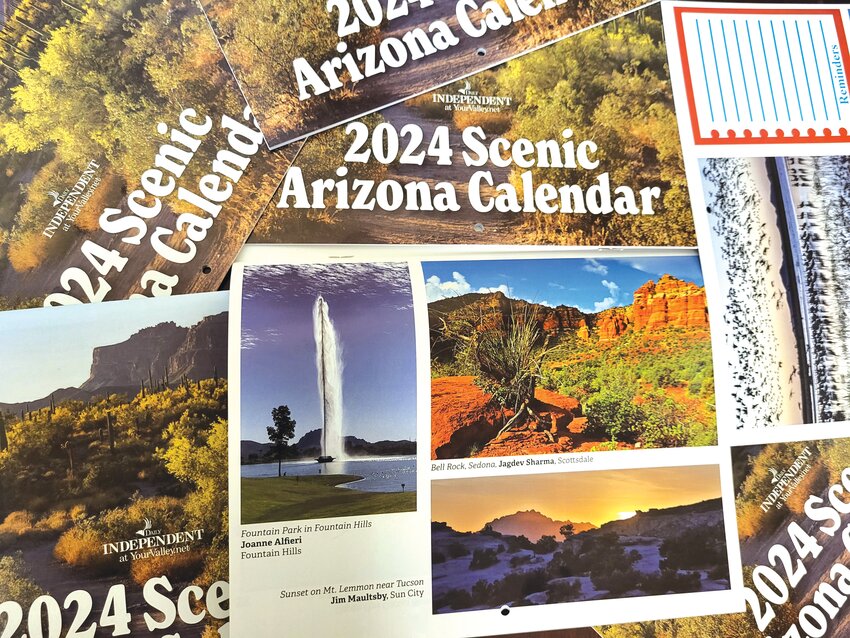

The Daily Independent at YourValley.net invites readers to submit photographs of desert landscapes, wildlife and prominent landmarks to be used in the 2025 Scenic Arizona calendar. These should be …

neighbors

This month, Peconic First Books announced the release of The Days Before Tomorrow , a debut novel by Mark Hass, a Paradise Valley resident, former journalist and Arizona State University professor.

…

neighbors

Christ Church of the Ascension in Paradise Valley has appointed Tigran Buniatyan as music director for the parish.

Buniatyan received his bachelor’s and master’s degrees in organ and …

Read more