election

Timothy Dickman has withdrawn as a candidate for Paradise Valley Town Council as of April 17 after being informed that Council Member Ellen Andeen was suing him in Maricopa County Superior Court with …

submission

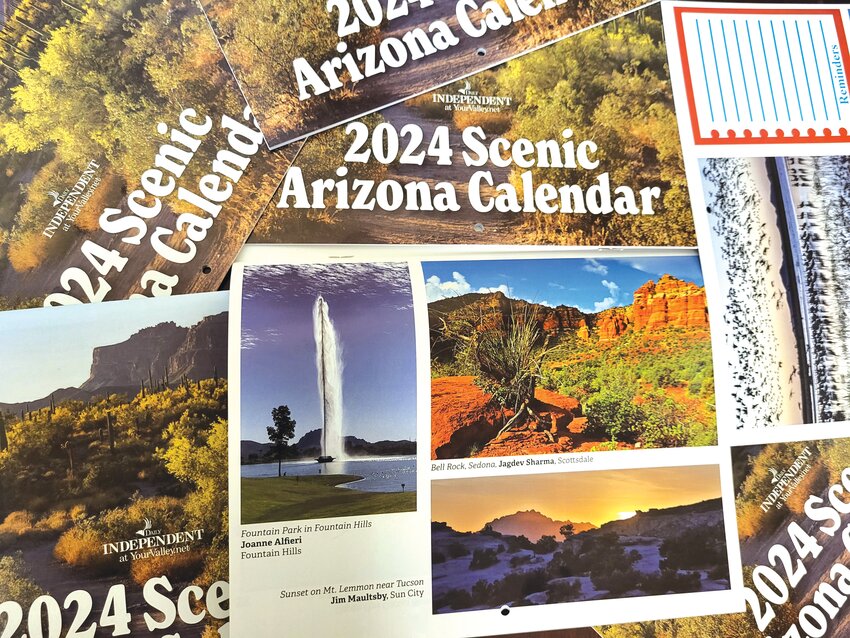

The Daily Independent at YourValley.net invites readers to submit photographs of desert landscapes, wildlife and prominent landmarks to be used in the 2025 Scenic Arizona calendar. These should be …

neighbors

This month, Peconic First Books announced the release of The Days Before Tomorrow , a debut novel by Mark Hass, a Paradise Valley resident, former journalist and Arizona State University professor.

…

neighbors

Christ Church of the Ascension in Paradise Valley has appointed Tigran Buniatyan as music director for the parish.

Buniatyan received his bachelor’s and master’s degrees in organ and …

finance

The Town of Paradise Valley’s expenditure limitation was recently finalized for fiscal year 2024-25 at $45.679 million.

The expenditure limitation is based on population calculated by the …

finance

In December, a financial audit suggested a "segregation of duties" for the Paradise Valley Mountain Preserve Trust.

That suggestion has been implemented by the Town of Paradise Valley, …

SUSD

The Scottsdale Math & Science Academy (SMSA) celebrated its students’ recent projects and achievements at the annual STEAM showcase on Saturday, April 13.

The SMSA is a specialized …

Tasty treats

Fueling the premium cookie trend sweeping the nation, Cookie Plug, a cookie concept that combines graffiti, street art and hip-hop culture has entered Paradise Valley Village.

Selling cookie …

As long as he can remember, Michael Beck has always had a love of books.

It’s a good trait to have for a librarian, but as the new director of Scottsdale’s Library System, Beck wants …

nonprofit

In a “mini antique roadshow,” free appraisals and an opportunity to donate antiques and collectibles will be offered at Phoenix Antique Emporium and Lamp Shop, 2225 E. Indian School Road, …

Read more