neighbors

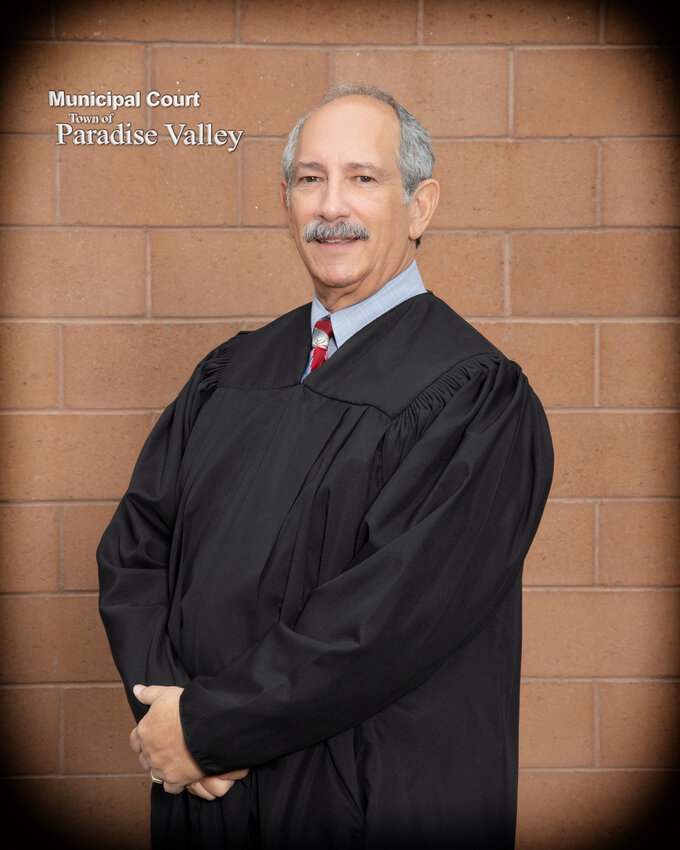

Steven A. Cohen was appointed as a judge pro tempore of the Paradise Valley Municipal Court in 2001 and continues to proudly serve his community in that capacity.

He currently runs his own law …

police

Nearly $5,000 was raised from the 10th annual Safely Shred and Electronics Recycling event with the Paradise Valley Police Department and Paradise Valley Wealth Management, Inc., according to a PVPD …

education

Cole Marc Schmittlein is among more than 8,000 candidates for graduation in the University of Georgia’s Class of 2024 who will be celebrated during commencement this week.

Schmittlein is a …

election

Candidates running in the July 30 primary election for Paradise Valley Town Council mayor and member seats reported their first-quarter finances last month.

For the reporting period Jan. 1-March …

Lasting legacy

The Scottsdale Resort recently unveiled its $40 million dollar renovations Thursday, May 2, with a ribbon cutting ceremony among City Council members along with the owners of Driftwood Hospitality …

business

Medalist Legal, an award-winning law firm specializing in business and real estate law, has announced the promotion of Brandon Bodea to managing partner.

Bodea brings a fresh perspective and a …

real estate

In cities across the country, certain streets are not just thoroughfares — they are symbols of status and sophistication that offer more than an address, but rather a lifestyle. For real estate …

resort dining

LON’s at The Hermosa Inn has received two new accolades from OpenTable.

For the fourth consecutive year, LON’s at the Hermosa has been named by OpenTable one of the Top 100 Brunch …

business

Paradise Valley-based Wilde Wealth Management Group has announced Jeffrey Anthony, certified financial planner from Chandler, is named the first chief growth officer of the firm.

In the newly …

travel + Leisure

Out of thousands of resorts and hotels in the world, three of the top 500 are in the Town of Paradise Valley.

This year’s Travel + Leisure’s 500 list recognized The Hermosa Inn, …

Read more